Submitting Your Tax Exemption DocumentsUpdated a day ago

Submitting Your Tax Exemption Documents

Please ensure that you carefully go through all the frequently asked questions (FAQs). This will greatly assist in expediting the processing of your Tax Exemption request.

Things needed to complete a Tax Exemption Form:

- You must have an account in our system prior to submitting tax forms; otherwise, it will cause delays in processing

- The name/email/phone number on your account with us

- Your business name and address used when applying for tax exemption status with your state

- This must be updated in your account prior to starting the tax exemption form

- The name/email/phone number on your account with us

- Resale license/permit or manufacturing license/permit (if applicable)

Please log into your account and complete the tax exemption request documents.

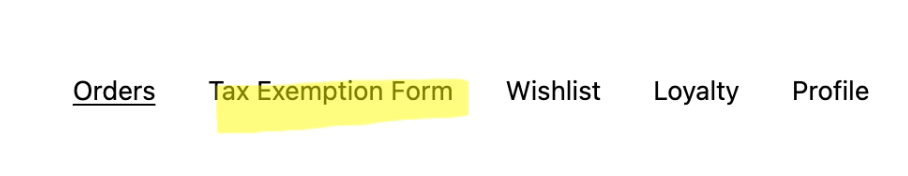

You will find the tax exemption area on the top left-hand side of your screen. It will look like this:

After logging in for tax, you will be taken through a series of forms and questions.

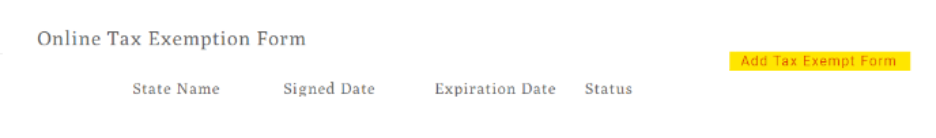

Please note – depending on your state, you could see the following, select “Add Tax Exempt form:”

Upon receipt of your submission of tax documents, our tax team will proceed to validate your information. You will receive communication through the email address linked to your submission if additional information is required. Kindly be aware that you will not be tax-exempt from Wholesale Supplies Plus until you receive an official notification.